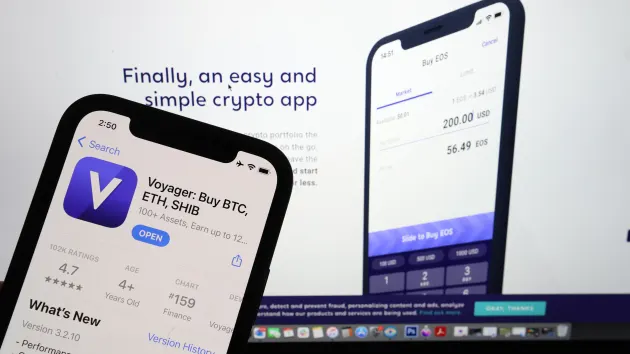

After FTX's demise, Binance and other cryptocurrency companies are preparing bids for the insolvent Voyager Digital

After FTX, which had initially planned to acquire the company, filed for bankruptcy, Binance and other cryptocurrency companies are planning takeover approaches for troubled digital currency lender Voyager Digital.

Voyager filed for Chapter 11 bankruptcy protection in July after cryptocurrency hedge fund Three Arrows Capital stopped making payments on a $670 million loan from the company. Chapter 11 bankruptcy protection aims to rebuild struggling companies as functional commercial operations.

Following Sam Bankman-victory Fried's company in a U.S. bankruptcy auction, Voyager was scheduled to be purchased by FTX's American division, FTX U.S., for $1.4 billion. It was subsequently forced to start over after FTX declared bankruptcy after seeing a rise in withdrawals akin to a bank run.

Since Voyager halted withdrawals due to a liquidity issue that affected the entire sector, customers have been unable to withdraw their money.

This past week, Binance verified rumors that its American affiliate Binance.US intended to submit a proposal to save Voyager from ruin. Voyager has previously been up for sale through an insolvency auction hosted by Binance.US.

Changpeng Zhao, CEO of Binance, stated Binance on Bloomberg. Given that FTX can no longer keep its promise, US "will make another bid for Voyager at this time."

Zhao has also established a $1 billion fund to aid struggling businesses in the sector.

One of the earliest bidders for Voyager in the court auction was CrossTower, a crypto, and NFT trading platform. Though specifics are currently lacking, the business claims it expects to make a revised offer for the company.

An email from a CrossTower representative to CNBC stated that the company is "submitting a revised offer, one it feels will benefit both the clients and the larger crypto community."

Additionally, CrossTower is preparing its own unique industry recovery fund. The company informed CNBC that it does not consider the fund to be in "competition" with Binance's.

The CrossTower representative stated, "This is about stabilizing an industry, recovering trust, and reconstructing what is arguably the future of finance."

"We will work with governments and policymakers to encourage transparency, and we will do so with resources and talent. The technology industry was not built by one venture fund, and this one will not be rebuilt by one recovery fund.

A story from London's Financial News newspaper claims that Wave Financial, who first lost out to FTX, is also preparing to make a second offer to purchase Voyager.

When approached by CNBC over WhatsApp, Matteo Perruccio, Wave's president of international, declined to comment on the allegation. Perruccio said in a statement to CNBC last month that his business "thought that our bid was better for the investors and the debtors."

In the interview from October, he added that Wave's offer "saw us reinvigorating VGX," Voyager's exchange token.

Customers of Voyager are hoping that any corporate bailout of the company will include the use of VGX, a token that Voyager developed as a form of loyalty rewards program that offers reductions in trading fees.

Perruccio said to CNBC in October, "We also had some, I think quite creative ideas about how to deliver traffic at a much cheaper cost of acquisition at a higher per client balance, which were the two key concerns at Voyager."

Voyager stopped trading and transferring VGX in August and announced a proposal for users to exchange their tokens for new ones on a different platform. Uncertainty surrounds the token's future, which has decreased by more than 85% since the year's beginning.

For $10 million, FTX U.S. had offered to purchase all of the VGX that Voyager and its affiliates had. Voyager, however, stated that it was trying to come up with a "higher and better solution" for the token that was compliant with the offer made by FTX U.S.

Along with its parent business and other affiliates like Alameda Research, FTX U.S. is currently involved in bankruptcy proceedings in a Delaware court. Voyager first turned down the company's offer, calling it a "low-ball proposal disguised up as a white knight rescue."

Ethos.io, a startup that Voyager purchased in 2019, is another participant in the complex reorganization process. Only Ethos.io's technology was acquired by Voyager, and once Voyager failed, the company intends to relaunch itself under a different name.

Co-founder of Ethos.io Shingo Lavine claims that Voyager's development of its crypto capabilities was largely aided by the technology of his company. After adding support for dogecoin, a virtual currency inspired by memes, Voyager experienced considerable growth, he continued.

The company has formed its own recovery mechanism for owners of VGX and creditors of Voyager, according to Shingo Lavine's father Adam Lavine, who is also a co-founder of Ethos.io, and it has "received a nice response so far across the Voyager community."

The rehabilitation initiative has received so far "several thousand users representing 10% of the overall VGX market cap," according to the elder Lavine. When contacted by CNBC, Voyager did not immediately respond to requests for comment.

Source: CNBC

Post a Comment